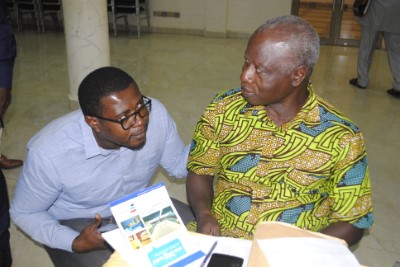

To strengthen GIRSAL’s relationship with stakeholders and help them understand our operations, GIRSAL held a consultative meeting with some members of the National Farmers and Fishermen Award Winners Association of Ghana (NFFAWAG), FBO Leaders, Agric Entrepreneurs and Financial Institutions at Eusbett Hotel in Sunyani on October 24, 2019.

The engagement introduced these groups to GIRSAL’s operation and responded to some misconceptions about GIRSAL.

The meeting, attended by 61 participants from the livestock, poultry, tree crops, horticulture and cereal sub-sectors and some rural banks in the Bono and Ahafo regions, sought to discuss selected value chains, the Credit Risk Guarantee systems, processes and achievements.

The Chief Operating Officer of GIRSAL, Mr Takyi Sraha, and other team members outlined GIRSAL’s intervention to solve the issue of agricultural guarantee for financial institutions to increase lending to the agric sector.

Mr Sraha, in his presentation, explained that the value proposition of GIRSAL is to share lending risks with Financial Institutions, therefore, increasing lending for agribusinesses.

The team took participants through the various value chain selection process and the selected value chains GIRSAL intends to support.

According to National Best Farmer for 2019, Mr Davies Korboe, Farmers and Agribusiness face many challenges in accessing credit from financial institutions irrespective of agriculture’s contribution to GDP and employment creation.

He continued that farmers, therefore, see GIRSAL as one of the interventions by the government to assist farmers and agribusinesses in accessing credit from the financial institutions to support agricultural projects in Ghana.

Also at the meeting, the General Manager of the Ghana Agriculture Insurance Pool (GAIP), Alhaji Ali Muhammad Katu, presented the need for agriculture insurance, various agriculture insurance products available, and their pricing.

Participants had the opportunity to interact after the presentations to ask questions on issues of concerns about agribusiness financing.