GIRSAL, in collaboration with its partners, has successfully facilitated the 12th agriculture and agribusiness lending course for bankers in Ghana, furthering its support in enhancing agricultural finance knowledge.

In 2023, GIRSAL set an ambitious target of training 120 staff members from both commercial banks and non-banking financial institutions. Remarkably, not only was this target achieved, but it was also surpassed, with 151 participants hailing from 29 financial institutions completing the three planned cohorts for the year. Since the program’s inception in 2021, a total of 530 staff members from 39 financial institutions, have participated encompassing commercial banks, non-bank institutions, and rural and community banks, among others.

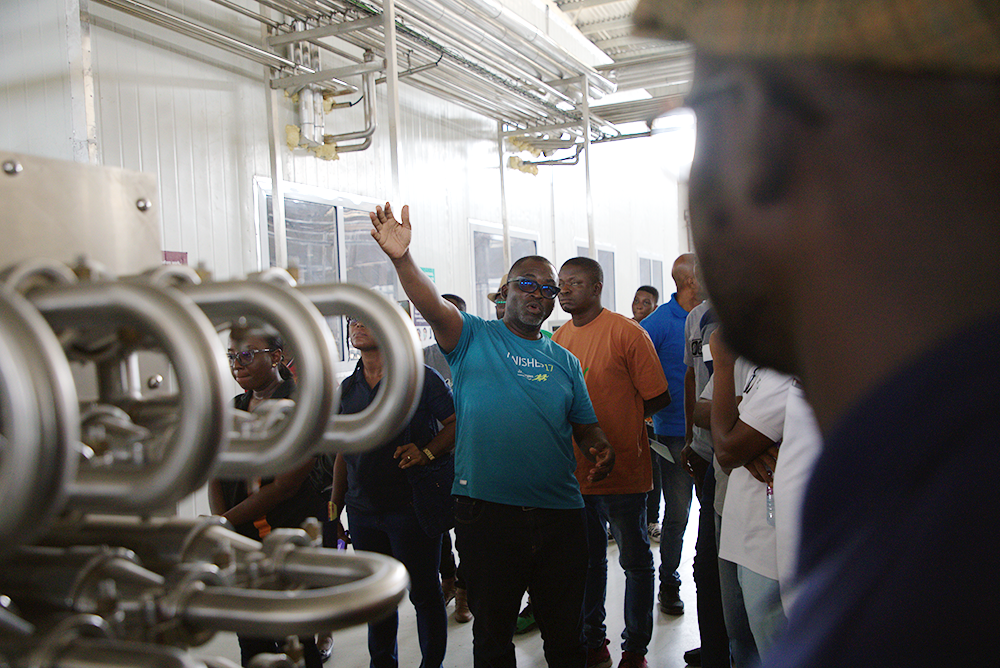

The course offers a balanced mix of theoretical classroom sessions and practical field tours. Participants dive into the intricacies of the agricultural and agribusiness environment, understand different agricultural value chains in Ghana, and learn about agricultural loan appraisal and management techniques. Field excursions to various agricultural settings, including large poultry farms, horticulture plantations, and processing factories, provide invaluable hands-on experience and a clearer understanding of the agricultural value chains.

It is strategically designed to empower financial institutions by enhancing their knowledge in agriculture and agribusiness. This ensures that they are well-equipped to efficiently evaluate, structure, and manage agribusiness loans, ultimately driving an increase in agricultural lending. By closing the knowledge gap between banks and the agricultural sector, GIRSAL is laying the groundwork for sustainable agricultural financing. Mr. Takyi Sraha, COO of GIRSAL, affirmed the organization’s dedication to continuously providing agricultural training for all banking staff. He emphasized the importance of cultivating a comprehensive understanding of the agricultural sector across the entire banking industry to ensure informed decision-making and bolster the synergy between finance and agriculture in Ghana.

Participants of the training program have attested to its profound impact on both their personal growth and their professional roles.

Mr. Anthony H. Mills, a Sales and Service Manager with Fidelity Bank, confirmed the training’s effectiveness. He praised the comprehensive presentation of knowledge and materials related to various value chains by the facilitators. Describing the training as a harmonious blend of theory and practice, Mr. Mills found it engaging and highly informative. He expressed his gratitude towards GIRSAL for introducing this invaluable training program and strongly recommended its continuation for the benefit of others who have not yet had the opportunity to participate.

Mr. Kingston Konadu from Ejuraman Rural Bank noted that while the training’s focus was on agriculture and agribusiness, it also substantially enhanced his skills in credit analysis and facility management, especially in livestock-related agricultural facilities. He praised the program for offering insights into effective loan appraisal and facility oversight, thereby contributing to his professional growth.

With the conclusion of the 2023 cohorts in September, GIRSAL is already gearing up for the next series of training programs set to commence in 2024. The Agriculture and Agribusiness Lending Course was created through a partnership between GIRSAL and the National Banking College (NBC), with support from AGRA. It is currently being conducted at the NBC, co-funded by GIRSAL, and the Development Bank Ghana.